Staying calm in turbulent markets

Periods of volatile markets can feel unsettling, especially when the news headlines are shouting loud. To own a share in a company means to stake a claim in the future cash flows associated with ownership. Profits can be distributed to stockholders through dividends or share price appreciation. These expected future cash flows carry a high degree of uncertainty in their magnitude and timing. Markets are never a smooth ride.

As news reaches the stock markets, investors interpret it and reassess the company’s prospects. This leads them to adjust their perception of the stock’s fair value, which reflects the value of partial ownership in the company. Positive news can increase investors’ confidence or expectations for higher future cash flows, while negative news can have the opposite effect.

Recent market turbulence, largely attributable to uncertainty around the impacts of economic policy changes and proposals in the United States, is a reminder that stock ownership is not a free ride. At time of writing, US stock markets are at similar levels to where they were before the election of Donald Trump. Uncertainty abounds, but then again it always does.

Understanding that new information gets priced into stock markets quicker than most investors can react, means that most would do well to accept the current stock price as fair. Trying to second guess stock market prices is a game left to those that have the confidence and ability to do so. Whilst many have no shortage of the former, the evidence suggests that few – even the professionals – possess the latter.

Investors are therefore left with little choice but to ride out stock market turbulence and accept that stock ownership can come with a bumpy ride. There are no easy answers – patience and fortitude are required.

At times like these, it is important for investors to remind themselves of some important principles to avoid the risk of making decisions that could lead to poor – perhaps disastrous – outcomes. This short note also presents some powerful graphics which can bring comfort to long-term investors.

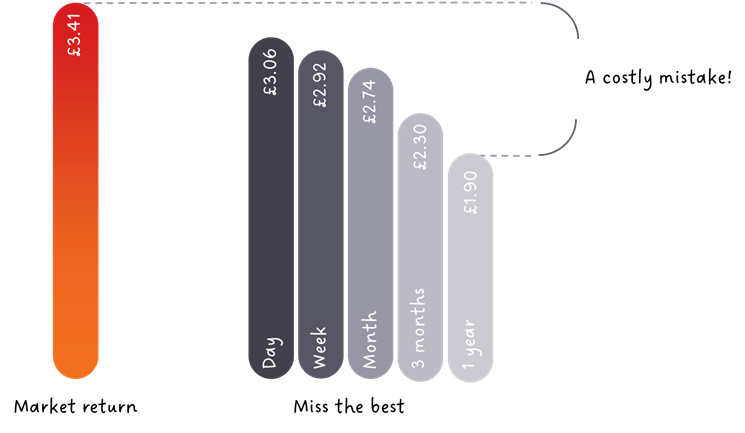

Reminder #1: Avoid trying to time when to be in or out of markets

Investors face a temptation to ‘wait out the storm’. However, research[1] suggests that few investors, whether professional or otherwise, possess any ability to successfully time when to be in or out of markets. The risk of trying to do so can be extremely costly, as the graphic below demonstrates.

Figure 1: Market timing can be costly

Source: Albion Strategic Consulting. Albion World Equity Index (https://smartersuccess.net/indices). Jul-07 to Dec-24. Daily returns in USD.

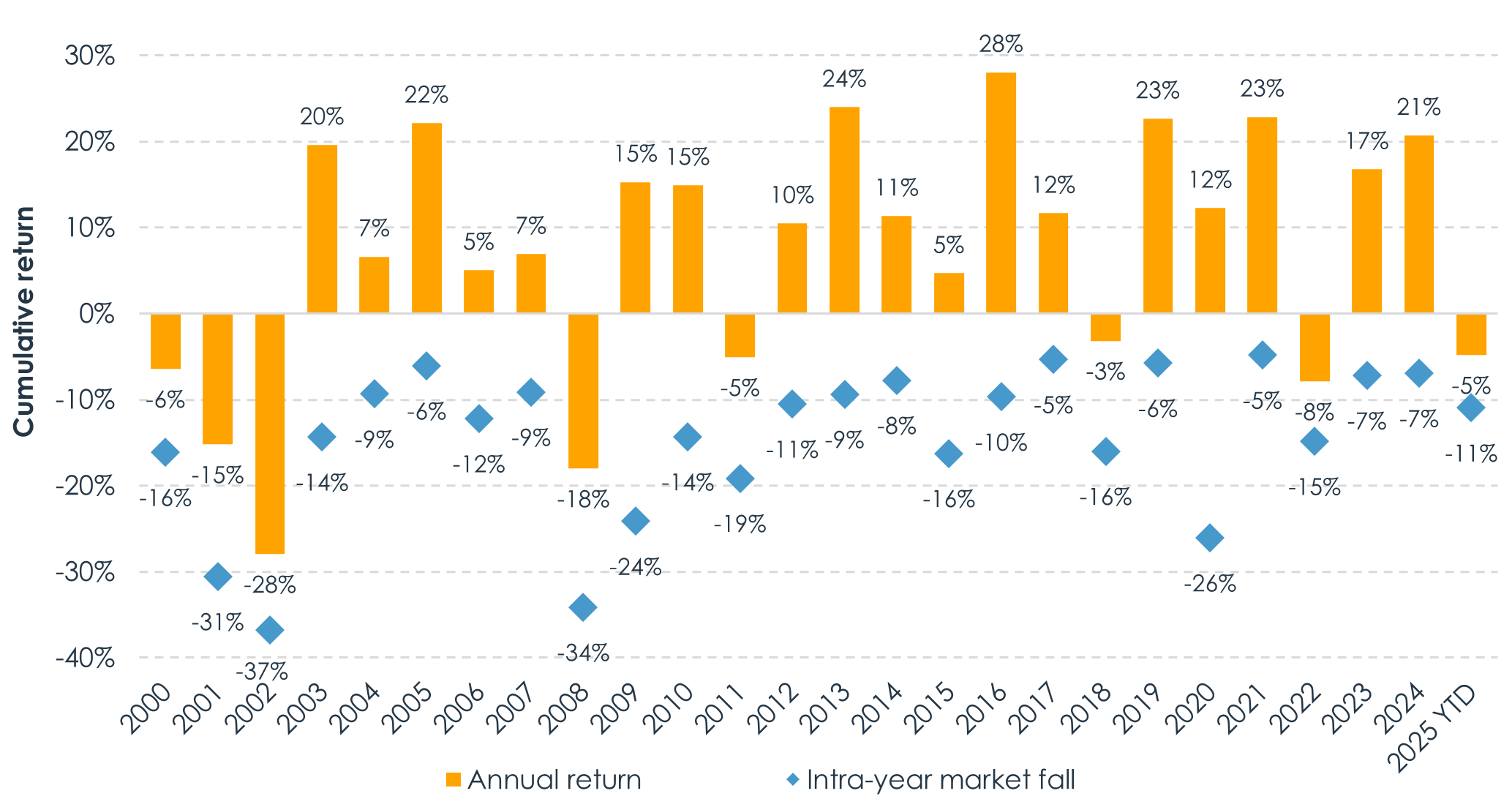

Reminder #2: The market falls from a peak every single year

The stock market falls from a high at some point every year. Current levels of global stock market falls are commonplace. This does not make it easy to remain invested through such bumps in the road, but it is vital to do so. Where markets go from here; nobody truly knows. The release of new information– which is, by definition, random – and how it is processed by investors will determine this.

Figure 2: Every year, the market falls – global

Source: Albion Strategic Consulting. Data: Vanguard Glb Stk Idx $ Acc

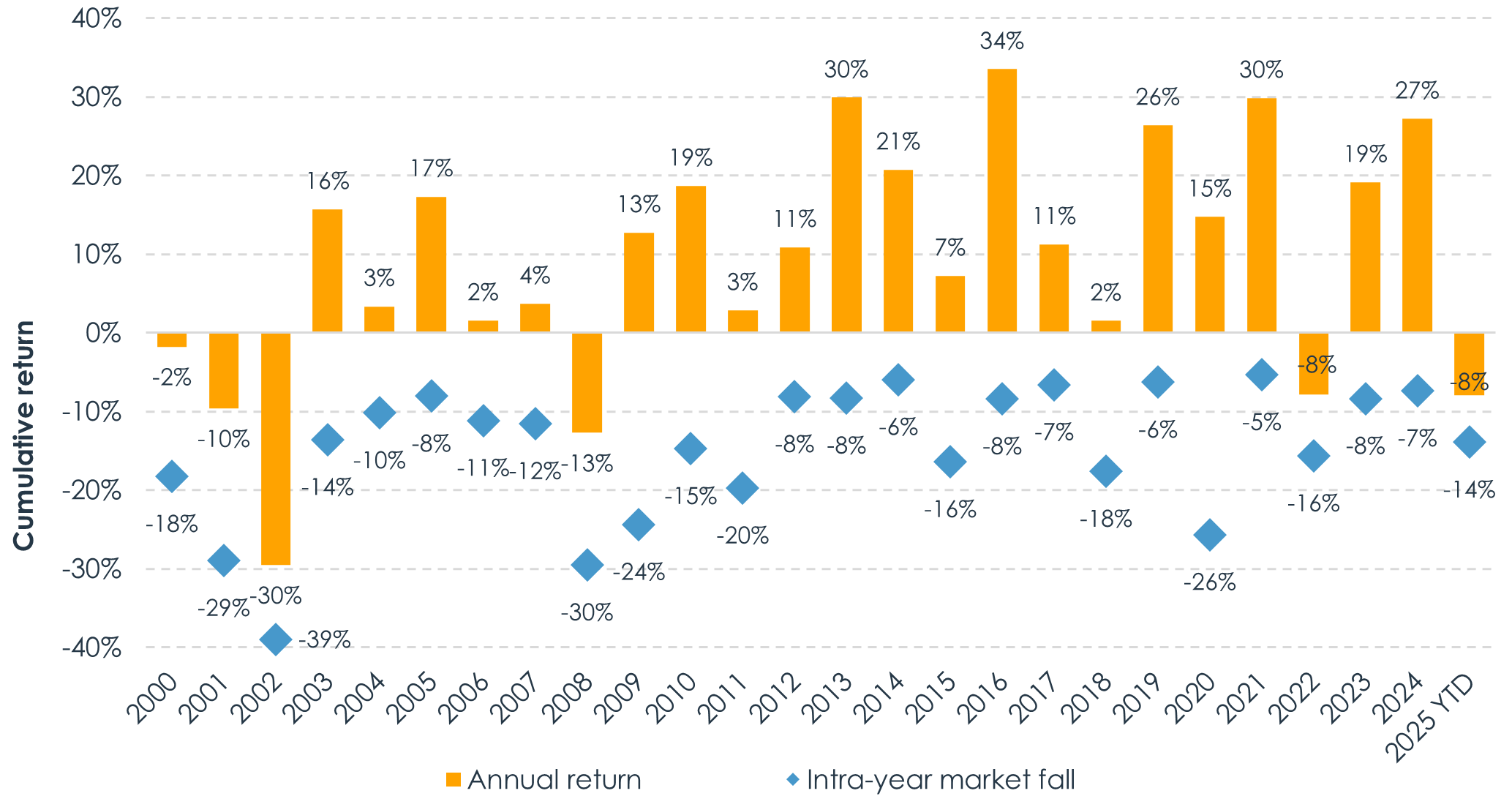

Looking at US stock markets specifically, where investors are currently experiencing most hurt, shows exactly the same story.

Figure 3: Every year, the market falls – US

Source: Albion Strategic Consulting. Data: Vanguard Institutional Index I.

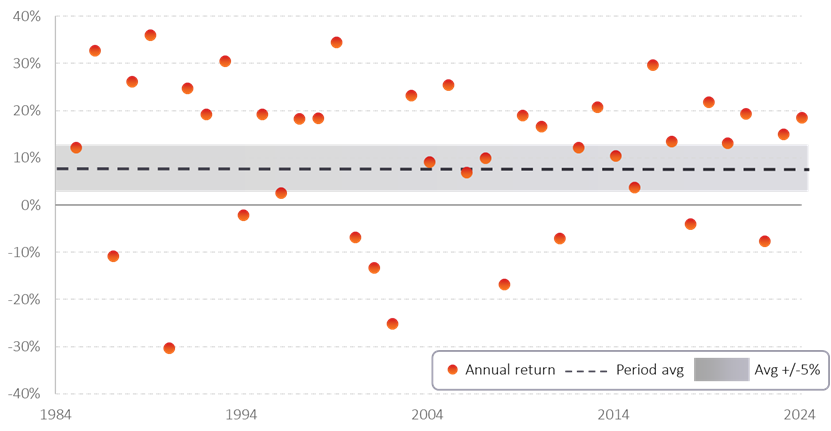

Reminder #3: Volatility is already factored into your financial plan

Volatility – a statistical measure representing the bumpiness of the ride – is always inherent in markets. Assumptions of investing returns incorporate an expectation of interim volatility. Significant and protracted stock market declines from time to time are expected as a feature of markets. This is understood when making the appropriate decision in our investment recommendations to you.

Falls in the value of investments can be curtailed through owning exposure to companies around the world (diversification) and an appropriate amount in high quality bonds, though they cannot be avoided. Making sensible assumptions for the future helps investors retain realistic expectations of investing outcomes and increase the chance of investing success by avoiding bad investor behaviour.

Figure 4: Market returns vary widely around the average

Source: Albion Strategic Consulting. Albion World Stock Market Index. 1985-2024. Returns in USD.

Things may worsen before they get better, but they may not. Only with the benefit of hindsight will anyone know for sure.

Important notes

This is a purely educational document to discuss some general investment related issues. It does not in any way constitute investment advice or arranging investments. It is for information purposes only; any information contained within them is the opinion of the authors, which can change without notice. Past financial performance is no guarantee of future results.

Products referred to in this document

Where specific products are referred to in this document, it is solely to provide educational insight into the topic being discussed. Any analysis undertaken does not represent due diligence on or recommendation of any product under any circumstances and should not be construed as such.

[1] E.g. Dai, Wei and Dong, Audrey, Another Look at Timing the Equity Premiums (October 11, 2023). Available at SSRN: https://ssrn.com/abstract=4586684 or http://dx.doi.org/10.2139/ssrn.4586684