Currency risk through a long-term lens

One of the recurring themes in financial media this year has been the US dollar. After decades of strength, the dollar has depreciated against major currencies so far in 2025 – GBP, EUR, JPY, AUD, CHF, for example – prompting speculation about whether this signals the beginning of the end for its status as the global reserve currency. For globally diversified investors, this raises an important question: what could US dollar depreciation mean for long-term returns?

Consider a typical global stock portfolio with around 65% of the allocation in US stocks, which is about the market weight of the US at time of writing. If the dollar weakens relative to other currencies, those holdings translate into fewer pounds, euros and yen.

For example, imagine starting the year with $100 of US stocks worth around £80. After a 20% rise in US markets, that $100 becomes $120. However, if over this period the dollar falls meaning $1 now only buys you £0.75 at the end of the year, the GBP value of that $120 is just £90 – a return of 12.5%, not 20%. This dynamic broadly reflects what we’ve seen in 2025, albeit with less dramatic numbers.

Five points to remember on currency risk

1. Markets look forward

Just like stock markets, currency markets price in expectations about the future and are exceptionally difficult to forecast. If everyone believed the dollar was set to fall further, it would already have done so.

2. Currency is volatile

Short-term swings can feel dramatic. In 2008, during the global financial crisis, the dollar surged nearly 40% versus other major currencies as investors sought safety. In other periods (e.g., 1985 and 1987), the reverse occurred.

3. Don’t forget about bonds

Most investors transfer currency risk to another party in their bond funds – this is known as ‘hedging’. Bonds are an insurance policy to protect against stock market downturns, as we saw once again earlier this year.

4. Diversification is your friend

Global diversification means accepting exposure to global currency risk. Concentrating everything in one market or currency introduces its own risks and should be avoided – GBP in the early 1980s, which fell over 50% against the US dollar, or Japan’s stock market from 1990 to 2016, which went nowhere for over 25 years.

5. The long-term view

Since the first index fund launched in 1977, the US dollar has strengthened from ≈$2 per pound to ≈$1.30 per pound today. Yet, that S&P 500 index fund delivered 12.2% per year in GBP terms versus 11.6% per year in US dollar terms. Currency matters, but market returns matter more.

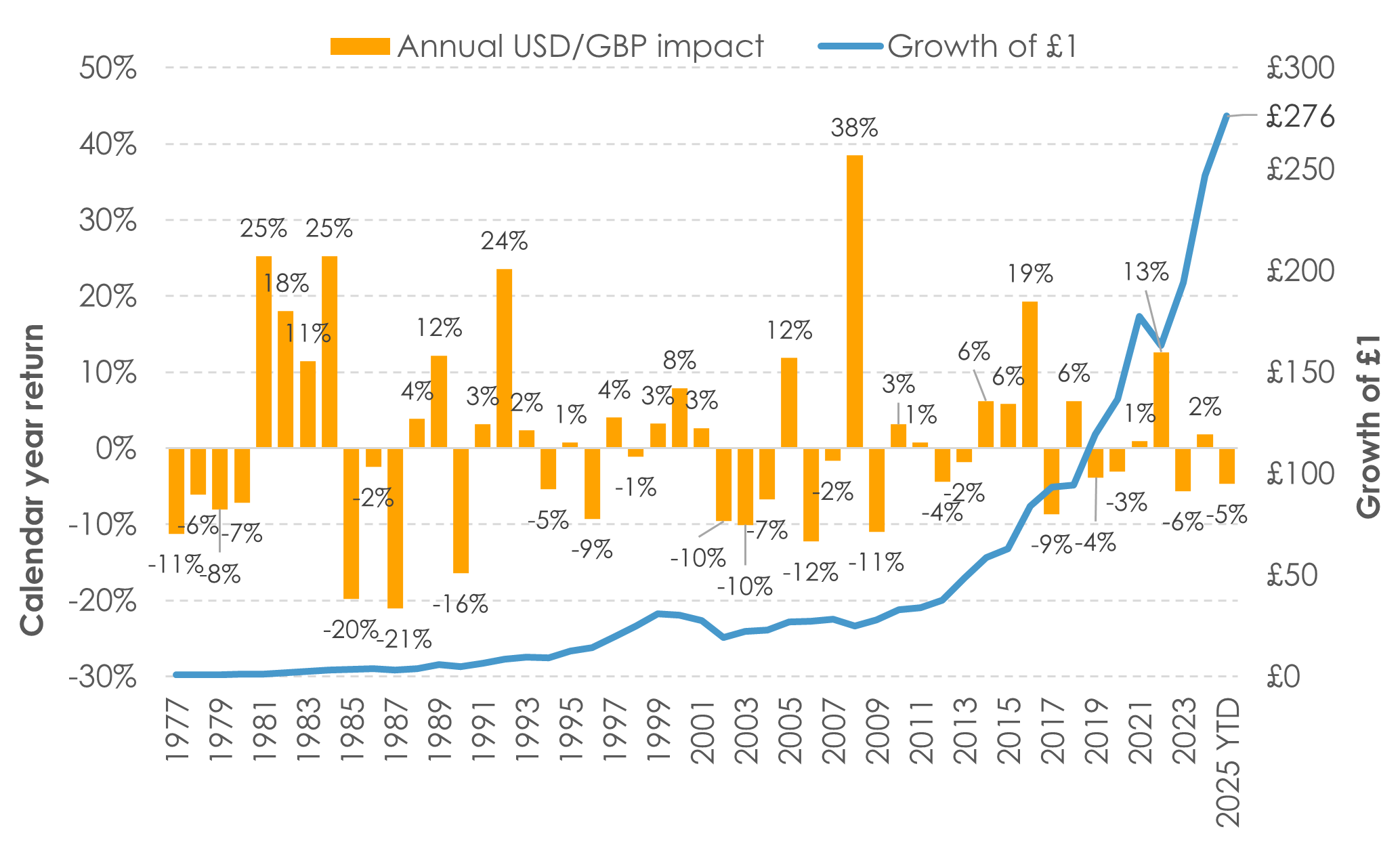

The chart below captures the last point by isolating the USD to GBP currency impact on stock market returns from the point of view of a UK investor. Each year, currency (orange bars) can swing wildly from +38% (2008) to -21% (1985), however, the underlying stock market returns dominate over the decades.

Figure 1: Long term USD to GBP currency impact

Data source: Vanguard S&P 500 Index Fund. Ticker: VFINX. Data period: 01/01/1977 – 31/10/2025.

Like most of the headlines one reads day-to-day, views on the status of the US dollar are already priced in to stock and bond markets. Your well diversified portfolio is based on the success of capital markets globally, through time, not the relative strength of the US dollar.

Important notes

This is a purely educational document to discuss some general investment related issues. It does not in any way constitute investment advice or arranging investments. It is for information purposes only; any information contained within them is the opinion of the authors, which can change without notice. Past financial performance is no guarantee of future results.

Products referred to in this document

Where specific products are referred to in this document, it is solely to provide educational insight into the topic being discussed. Any analysis undertaken does not represent due diligence on or recommendation of any product under any circumstances and should not be construed as such.