A few things about gold…

This shiny metal always glistens most brightly when it has just risen in value. In the past 12 months, the price of gold has nearly doubled. Recency bias and the fear of missing out (FOMO) always results in ‘should it be in my portfolio?’ type questions. Somewhat bizarrely, investors tend to get excited about assets that have already risen in value. If one is going to play a market timing game – generally not advisable as even the pros do not have any real track record in being able to do so consistently – a long-term investor should surely be more excited about an asset that has fallen substantially in value, not risen.

It is always too easy to jump onto the ‘it’s done so well, I want some’ bandwagon. After all, owning a gold-backed ETF is just a click away on a brokerage account. Switching from an emotional, intuitive brain to a more reflective mindset is always useful to avoid a hasty and potentially costly decision. Here are a few thoughts around gold that may be instructive or, at the very least, somewhat interesting.

Gold is in limited supply (on earth), but does this matter?

If all the gold ever mined were melted into a cube, it would measure just 22 meters on each side. For those keen on rugby, the base of the cube would reach from the try line to the 22m line. For tennis fans, the sides of the cube would be as long as a tennis court, give or take a meter. According to the World Gold Council, this represents 216,265 tonnes of gold mined so far. Unmined gold is estimated at around 50,000 tonnes. Investors who think that gold is out of this world would be right. Gold is created in the heart of massive stars during supernova explosions which produce the extreme conditions necessary for the formation of heavy elements like gold. Meteorites often contain small amounts of gold. Does that make it valuable? Warren Buffet, the legendary investor and founder of Berkshire Hathaway does not think so.

‘Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head…Gold, however, has two significant shortcomings, being neither of much use nor procreative… if you own one ounce of gold for an eternity, you will still own one ounce at its end’.

Warren Buffet, legendary investor, Founder of Berkshire Hathaway

Gold has a tarnished record as an inflation hedge

Despite being the only metal that does not corrode, its mythical reputation as a hedge against inflation is somewhat tarnished. The definition of an inflation hedge is an asset that moves in the opposite direction to the effect of inflation, not just an asset that delivers positive after-inflation returns over longer-term periods. Historically, gold has shown mixed results as an inflation hedge. During the 1970s, a period of high inflation in the U.S., gold prices soared, delivering impressive after-inflation returns. However, in other periods, gold’s performance has been less stellar. For example, from 1980 to 1984, despite high inflation, gold prices fell substantially. Other alternatives, such as owning shorter-dated inflation-linked bonds is likely (but not guaranteed) to offer a better direct and more immediate hedge against inflation.

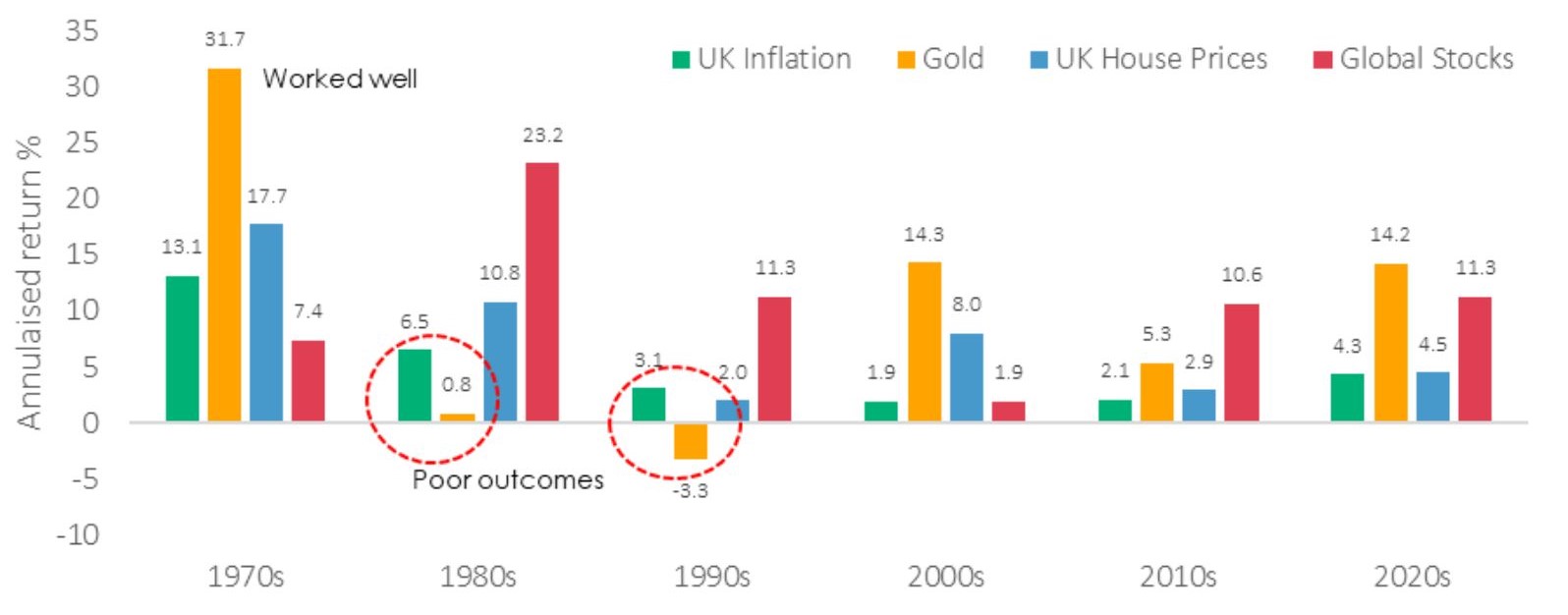

Figure 1: Gold prices compared to inflation and other assets 1-1970 to 2-2025

Gold has not performed that well against other assets

Gold has not been a particularly strong performer relative to global stocks over the past 50 years, despite its rip-roaring start to the 1970s. After the effects of inflation, £1 turned into £7 of purchasing power for gold, £3 for UK house prices and £16 for global stocks. It would have been painful to remove global stocks from a portfolio to make way for gold. In addition, the gold price was quite a bit more volatile than that of global stock markets, by about a quarter in fact.

Gold is a good store of value if you have a 2,000-year horizon, but not in the shorter term

Over the period from January 1980 to July 1999, gold lost around a staggering 80% of its purchasing power, making it a very untrustworthy store of value even over decades. Over the same period, the purchasing power of global stocks rose seven-fold. Over millennia gold does, however, seem to be a good store of value! For example, 34 ounces of gold would have paid the salary of a Roman centurion or a British Army captain today. A pair of shoes then, and now, cost around 0.02 ounces of gold, whilst two Roman togas or a suit today would cost about the same . Interesting but largely irrelevant to investors.

Timing when to invest in gold is tricky – just ask Gordon Brown

In summary, gold has no income stream, making it hard to value. Supply and demand changes over time, depending upon a wide range of factors, which are largely unpredictable. Its longer-term return has been materially less than that of global stocks. Its mythical status as a hedge against inflation is wearing a bit thin. It is hard to make a case for it as a permanent part of a portfolio. That implies that an investor needs to time when to be in or out of gold, which has proven to be extremely difficult. Just ask Gordon Brown, the former Chancellor of the Exchequer in the UK. Between 1999 and 2002, he sold approximately 395 tonnes of the UK’s gold reserves at average price of USD275 per ounce, a multi-decade low in the gold price, leading to significant criticism and the term ‘Brown’s Bottom’! If he had sold the gold at today’s prices, it would have been worth around ten times as much. This is probably one of the biggest single market timing mistakes of all time. Caveat emptor! All that glistens…etc.