An introduction to Relevant Life Cover

Why do you need life cover?

Plenty of events will come up in your life which will have an impact on you and your family, for example taking out a mortgage, marriage or having a baby. These events will have both an emotional and financial impact on your life.

It can be hard to understand if your family would be financially secure if the worst were to happen to you. Questions may crop up such as “can my spouse/partner afford to pay the mortgage if I’m gone” and “if I passed away, what effect would it have on my family”.

Life cover is important because it gives you the peace of mind that if anything were to happen to you then what’s most important in your life is protected. Knowing that their mortgage can be paid off and their family are financially provided for can rid you of any financial and emotional worries.

What is Relevant Life cover?

Relevant Life cover is a tax efficient way of protecting your family if the worst were to happen to you. It’s a type of life cover that is paid for through your business and pays a lump sum to your family. It’s designed to cover individual employees or directors of a business, as opposed to a Death in Service plan which covers a group of employees.

What are the benefits of setting up Relevant Life cover?

A lower cost

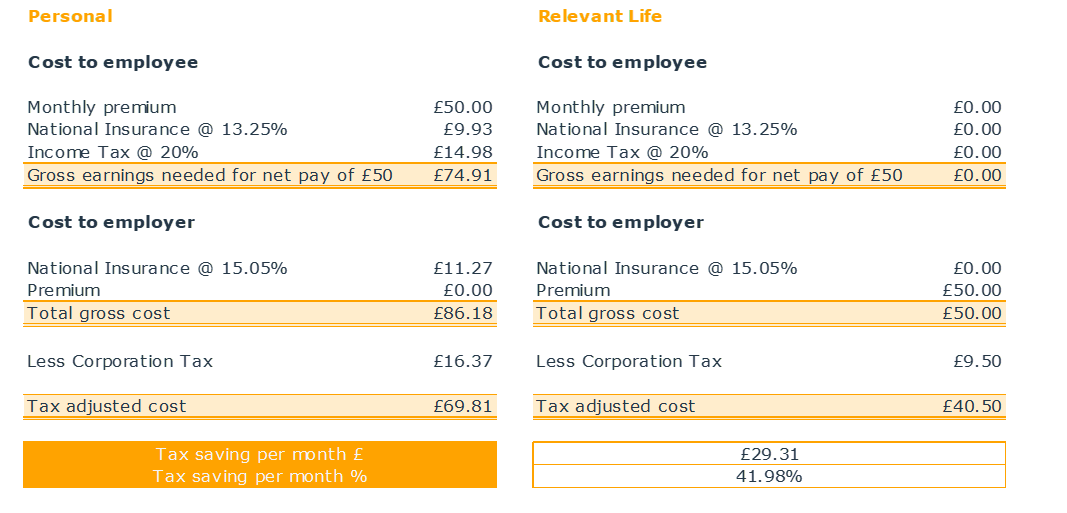

The premiums paid towards the life policy are an allowable expense (much like pension contributions), so for every £50 paid your company would save £9.50 in Corporation Tax (based on Corporation Tax rates for the 2022/23 tax year). The Corporation Tax saving is what makes Relevant Life cover more attractive compared to paying for cover personally. There are also additional tax benefits which the table below illustrates, based on a monthly premium of £50, assuming you pay Income Tax at 20% and National Insurance at 13.35%:

The savings will be different depending on your level of income and how you draw an income from your business, but the principle still remains that paying for life cover through your business is cheaper than paying it personally.

A Relevant Life plan with a monthly premium of £50 has a net cost of £40.50, whereas the same cover but paid personally has a net cost of £69.81. This is a saving of £29.31 per month, equivalent to 41.98% per month.

Tax benefits

Unlike many things paid for employees/directors of companies, the premiums paid for Relevant Life plans aren’t classed as a Benefit in Kind (BIK). This means that no Income Tax is due on the premiums.

The sum assured is paid tax free to your beneficiaries, and as the plan is written into a trust, the proceeds won’t form part of your estate for Inheritance Tax purposes.

WE can help you!

If you’re a company owner who’s looking to provide a benefit to your employees, or are looking to protect yourself and your family, then a Relevant Life plan may be suitable for you.

Talking to one of our Wealth Experts will help you to understand whether you need life cover and can quantify how much life cover you need.

Please note: This article is based on our understanding of current HMRC legislation which is subject to change.