Annual returns of stock markets

The annual returns of markets are unpredictable and can vary significantly from year to year. This randomness is a fundamental characteristic of financial markets.

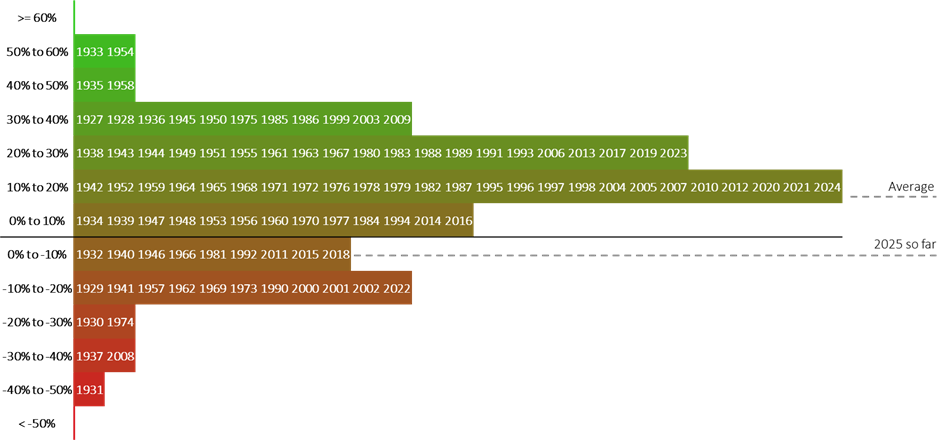

The graphic below shows that the distribution of stock market returns for each calendar year since 1927 forms a bell-shaped curve. This visual representation highlights the range of outcomes that can occur, from exceptionally good years to notably bad ones.

Figure 1: Annual stock market returns in context

Source: Albion Strategic Consulting. Albion World Equity Index (https://smartersuccess.net/indices). 1927 to 14th April 2025. Returns in USD.

Whilst 2025 so far sits on the wrong side of the zero line, it remains uncertain where stock markets will end up by the end of the year. The randomness of annual stock market returns serves as a reminder that short-term predictions are inherently unreliable. Good investing requires focusing on the things you can control (risk management, broad diversification, investing costs, avoiding emotional reactions), and accepting those you cannot.

Regardless of the direction of stock markets, most investors benefit from some protection mechanisms to reduce the impact of stock market swings:

- Owning bonds: High quality bonds can act as a buffer against heightened stock market uncertainty. They tend to perform well when equities are underperforming, as investors flee in search of ‘safer’ havens.

- Diversification: Spreading investments across a wide range of companies, sectors, and geographical regions can reduce the risk associated with any single investment.

- Regular portfolio rebalancing: Periodically reviewing and, if necessary, adjusting the portfolio to maintain the desired asset allocation can help manage risk. Rebalancing ensures that the portfolio remains aligned with the investor’s long-term goals and risk objectives.

For most investors, the spread of outcomes can be expected to be much narrower than that presented in the graphic above by using such techniques. Being diversified, diligent and patient in investing lends well to better outcomes.

As your adviser, part of our role is to ensure that you are invested in the solution that provides you with the best chance of achieving your financial goals whilst keeping risk at a level you are comfortable with. Our Investment Committee is responsible for the regular and thorough oversight of the investment solution we recommend. We are committed to thoughtful and consistent oversight and implementation of the investment strategy underpinning your financial plan.

Important notes

This is a purely educational document to discuss some general investment related issues. It does not in any way constitute investment advice or arranging investments. It is for information purposes only; any information contained within them is the opinion of the authors, which can change without notice. Past financial performance is no guarantee of future results.

Products referred to in this document

Where specific products are referred to in this document, it is solely to provide educational insight into the topic being discussed. Any analysis undertaken does not represent due diligence on or recommendation of any product under any circumstances and should not be construed as such.