Avoid predicting the unpredictable

Each year, investors face a barrage of commentary and speculation from the financial press about which stock, sector or country is set to do well in the coming months. The quotes below are taken from articles published by well-known media outlets and demonstrate that 2023 is no different:

‘2023 could be a very good year for renewables.’ – Forbes advisor

‘U.S. stocks have long dominated investor allocations, but it may be time to consider selectively owning emerging markets (EM) stocks’ – Morgan Stanley

‘We see energy sector earnings easing from historically elevated levels yet holding up amid tight energy supply. Higher interest rates bode well for bank profitability. We like healthcare given appealing valuations and likely cashflow resilience during downturns’ – Blackrock

‘Materials—especially metals—look even better than energy at the start of 2023, based on supportive valuations and this industry group’s past performance in periods of weaker manufacturing data.’ – Fidelity

Predictions and forecasts are all well and good, but investors would be wise to tread carefully before positioning their portfolio to benefit from narratives like the above. Many convince themselves that they have spotted a pattern in past returns, or that somehow the past can be used to navigate an uncertain future. They are likely mistaken. As Warren Buffet eloquently puts it:

‘Forecasts usually tell us more about the forecaster than of the future.’

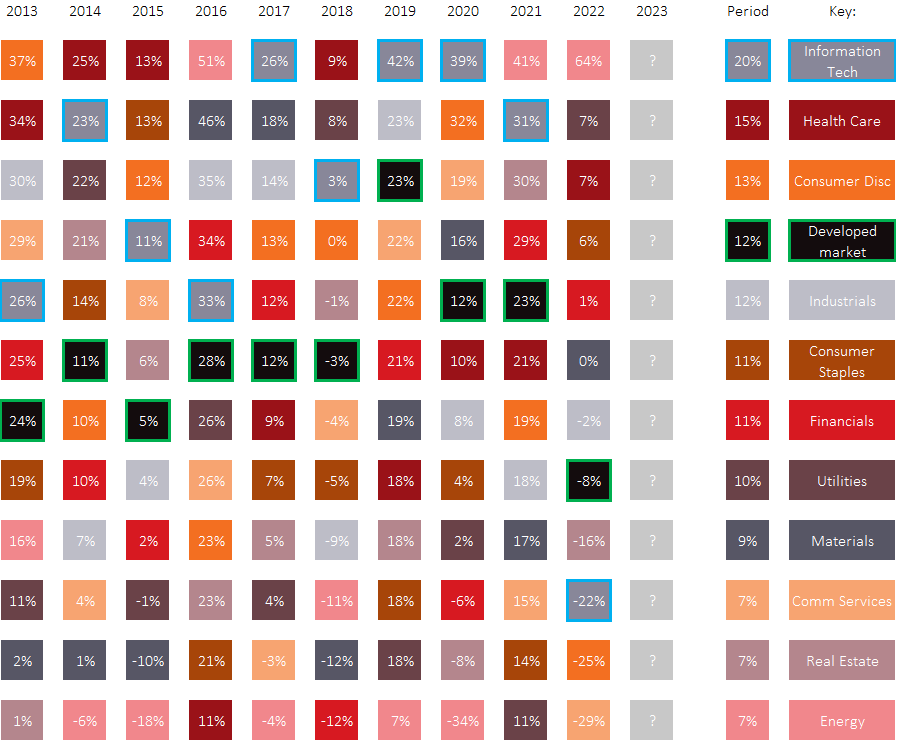

The chart below is sometimes known in the investment world as the ‘patchwork quilt’. This example focuses on sector performance in the last decade and each sector of the global developed equity market is represented by a different colour. The randomness of markets is well demonstrated. In 2014 and 2015, healthcare came out on top whilst energy stocks were rock bottom, however, in 2016 the roles reversed with energy delivering an ≈40% premium over and above healthcare stocks. Another topical example is that of technology. For the first 9-years of the decade, the tech sector beat the overall developed market every single year and came in the top three 2/3rds of the time. Last year, the streak came to an abrupt halt as technology fared relatively poorly. The energy sector, on the other hand, reaped the benefits of the surging post-pandemic demand for oil and gas, exacerbated by supply shocks caused by Russia’s invasion of Ukraine.

Figure 1: Developed market sector returns (2013-2022)

Data source: Morningstar Direct © All rights reserved. Indices: MSCI World (parent) and sector specific series. Returns in GBP.

The temptation to chop and change is strong. Over the last 4-years, a portfolio invested in a technology index fund at the start of 2019 and switched to an energy one in 2021 would have enjoyed outstanding average returns of around 46% per year . Whilst this would have been superb, it represents a classic case of investing using the rearview mirror. Hindsight is bliss.

The challenge that all investors face is that forecasting investment returns based on the information we have today is a highly challenging game to win consistently over the long term. If markets work, then prices effectively reflect an equilibrium position between the views of buyers and sellers and their expectations for the future. Unexpected shocks, such as pandemics, wars, financial crises, and political turbulence are quickly factored into expectations, and prices adjust accordingly. Very few individuals possess the skill (or fortune) to anticipate such events and reposition their portfolio appropriately.

Evidence from Morningstar’s database of global developed equities managers backs this up, indicating that of the 5,269 active funds available at the start of 2013, 3,242 (62%) failed to survive the period, 1,841 (35%) survived the period but were beaten by the broad developed market, and a mere 186 (4%) survived the period and outperformed . Take it from the late, great John Bogle:

‘We deceive ourselves when we believe that past stock market return patterns provide the bounds by which we can predict the future.’

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.