Avoiding the emotional cost of investing

We’d all like to think we’re capable of making rational decisions and not letting our hearts rule our heads. But when it comes to investing, emotions can often cloud the decision-making abilities of even the most sensible people.

Investors not only have to contend with the erratic and unpredictable nature of markets, but also the irrational way we can sometimes be tempted to think and behave. It’s easy to understand that being rational and listening to your head over your heart makes sense, but it can be much more difficult to put this into practice. Benjamin Graham, one of the great investment minds of the twentieth century, famously stated:

‘The investor’s chief problem – and even his worst enemy – is likely to be himself.’

What does irrational investing look like?

Irrational investing can manifest itself in many different ways, such as…

- Chopping and changing one’s investment plan influenced by what has just happened to the markets

- Trading shares in an online brokerage account

- Trying to pick market turning points, i.e. when to be in or out of different markets

- Being tempted into buying flavour of the month investment ideas or products

- Chasing fund performance

The list of irrational decision-making opportunities is long and undistinguished. John Bogle summed this up perfectly in an address to the Investment Analysts Society of Chicago (2003):

‘If I have learned anything in my 52 years in this marvellous field, it is that, for a given individual or institution, the emotions of investing have destroyed far more potential investment returns than the economics of investing have ever dreamed of destroying.’

What is the emotional cost of investing?

The ’emotional cost’ of investing means the impact on returns that are caused by our own behaviours – our actions or inactions – rather than the markets.

The temptation to try to get in (or out) at the right time is huge. Imagine if you could have avoided the 50% market fall during the global financial crisis of 07/08, or the blink-and-you’ve-missed-it COVID crash in early 2020, and bought in again at the bottom.

By and large, investors have a woeful track record of timing when best to jump in and out of markets. It is worth remembering that you have to get two decisions right when market timing. The first is when to get out. The second is when to get back in again. The problem is that markets work pretty efficiently at reflecting new information into prices (of e.g. company shares and bonds) quickly, and thus every decision you make is a bet against the aggregate view of all investors trading in the markets. Markets move on the release of new information which is, by its very nature, random.

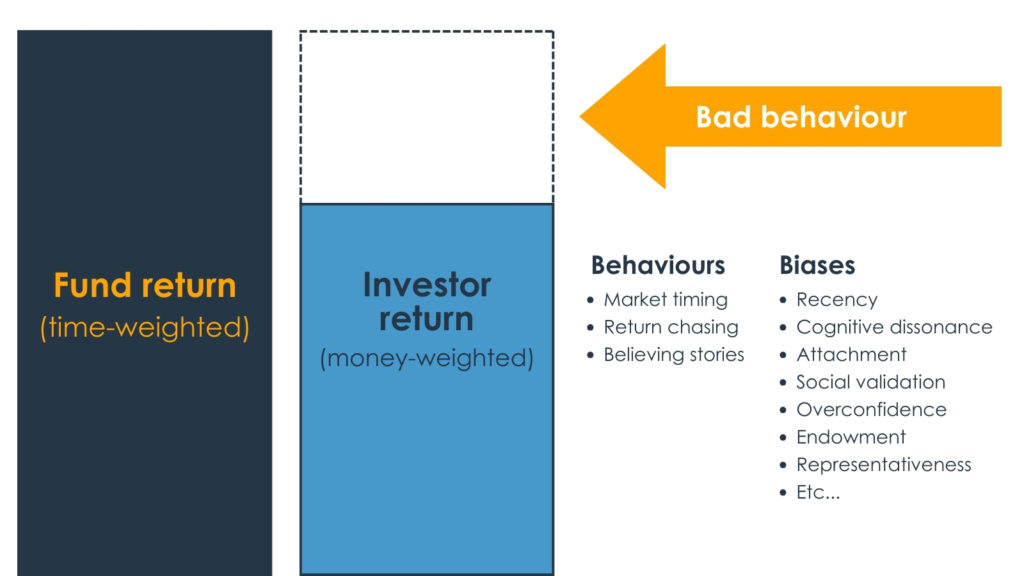

The returns that a fund delivers are known as time-weighted returns. The return an investor in a fund actually receives is known as the money-weighted return and will be impacted by the magnitude and timing of cash flows into or out of the fund that they make. A well-known piece of research from Morningstar’s ‘Mind The Gap (2023)’ report estimates this ‘behaviour gap’ to be around -1.7% per year on a large sample of US funds.

What does the emotional cost of investing look like?

Figure 1: The emotional costs of investing in theory

Source: Albion Strategic Consulting (from ‘Smarter Investing, 2004. FT Publishing © All rights reserved)

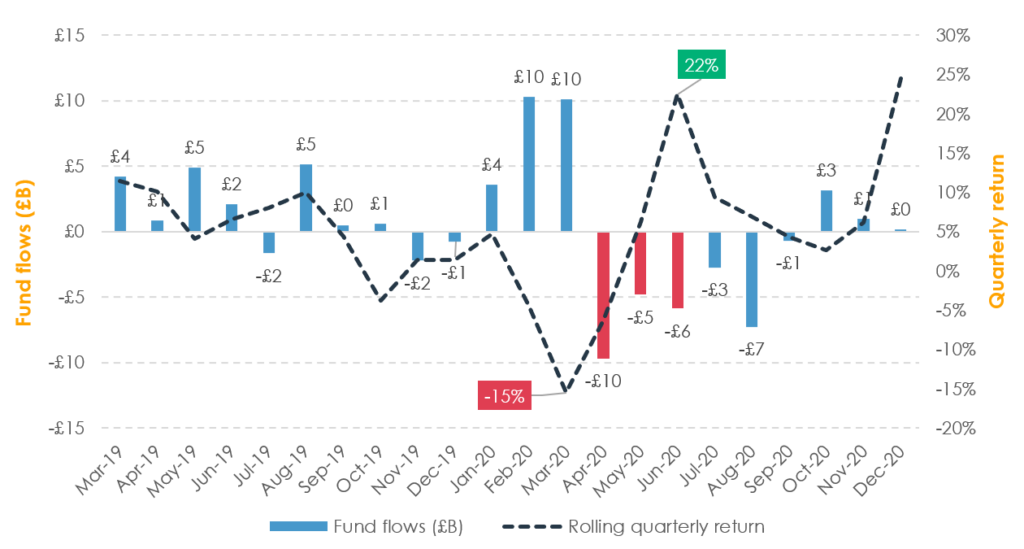

Let us look at an example of the ‘behaviour gap’ in action. The chart below shows the fund flows of the largest index fund in the world – the Vanguard Total Stock Index Fund – plotted against the rolling quarterly returns of the fund (in GBP terms). Following the COVID drawdown, negative fund flows persisted in the following months yet the market bounced back and was up 22% by the end Jun-20. This is the behaviour gap in action.

Figure 2: The emotional costs of investing in practice (3/2019-12/2020)

Source: Morningstar Direct © All rights reserved. Ticker: VTSMX

What’s the solution?

Own a sensibly diversified portfolio with sufficient higher-quality, shorter-dated bonds to provide protection from portfolio falls, allowing you to stay invested throughout these inevitable episodes of market turmoil that arise from time to time.

As John Bogle, the founder of Vanguard used to say:

‘This too shall pass!’

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Use of Morningstar Direct© data

© Morningstar 2024. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.