Bonds – between a rock and a hard place

Sometimes as an investor we come face to face with a stark reality. Today, that is the case with the bonds held in portfolios. By and large, most long-term investors own bonds because they do not have the emotional or financial capacity to suffer material falls in the value of their portfolio. By and large, high-quality bonds have done the job asked of them delivering protection from the large equity market falls in 2000-2003, 2007-2009 and Q1 2020. The return penalty of giving up equities to own bonds has been softened to some extent by positive returns in the past.

In December 1981 the yield on 5 year UK gilts stood at 15.5%. What would investors give today for such yields! The next 40 years proved to be good for bondholders as governments around the world got a grip on inflation and yields fell, delivering capital gains (bond prices rise as yields fall and vice versa) on top of the income delivered in the form of bond coupons (interest payments). Gilt yields fell from these lofty heights to a low of -0.06% in December 2020. Today, 5-year gilts yields have risen to around 1% (before inflation), which has resulted in small capital losses.

With current levels of inflation being well above the Bank of England’s target rate of 2%, bond (and bank deposit) holders face the real risk of the erosion of their purchasing power. In the presence of low yields well below inflation, and with the risk of rising yields – although no-one knows where yields will go from here – bonds seem unattractive from a return perspective going forwards.

So what’s to be done?

Investors have to ask themselves a tough question: ‘If I cannot cope emotionally or financially with suffering large equity market falls, what could I own instead if I abandon my high-quality bonds’.

Some investors have chased bonds with higher yields such as those issued by weak companies (high yield bonds) or those of emerging economies (including Russia), but this simply adds equity-like risk into the portfolio and dramatically reduces the defensive qualities of owning bonds. During the equity market falls of the Credit Crisis of 2007-2009 global high yield bonds fell by around 20% and during the Covid-induced fall in Q1 2020 they fell by around 15% .

High cost, opaque and highly complex, absolute return strategies, relying on manager skill alone, have hardly lived up to their name. Their sector average return during the equity market fall of Q1 2020 was down 8% or so .

The stark reality is that there are no easy answers, but there are a few useful points to remember:

- The return give-up of owning high quality bonds over equities should be thought of as an insurance premium. Today that premium is high. That is how the market is pricing it. Pay the premium or surrender the policy.

- Own bonds in your portfolio to a level that satisfies your emotional and financial ability to suffer equity market falls and no more. This is something that your adviser can talk you through. How much insurance cover do you need?

- High-quality bonds still have the ability to provide down-side protection and portfolio liquidity; two qualities not to be sniffed at.

- Accept slim pickings from bonds given such low yields and in the face of inflation. There is nothing you can do about it.

- Accept that there are no easy alternatives. All carry material trade-offs and risks.

Think of your investment pot in its entirety and avoid the trap of focusing in on one line on your portfolio valuation and pointing an accusing finger at your bonds. - Don’t get caught up with trying to second guess whether high quality, short-dated bonds or cash are likely to be the better option over the short or longer term. No-one knows and, when compared to the high volatility that equity markets exhibit, the two are pretty similar.

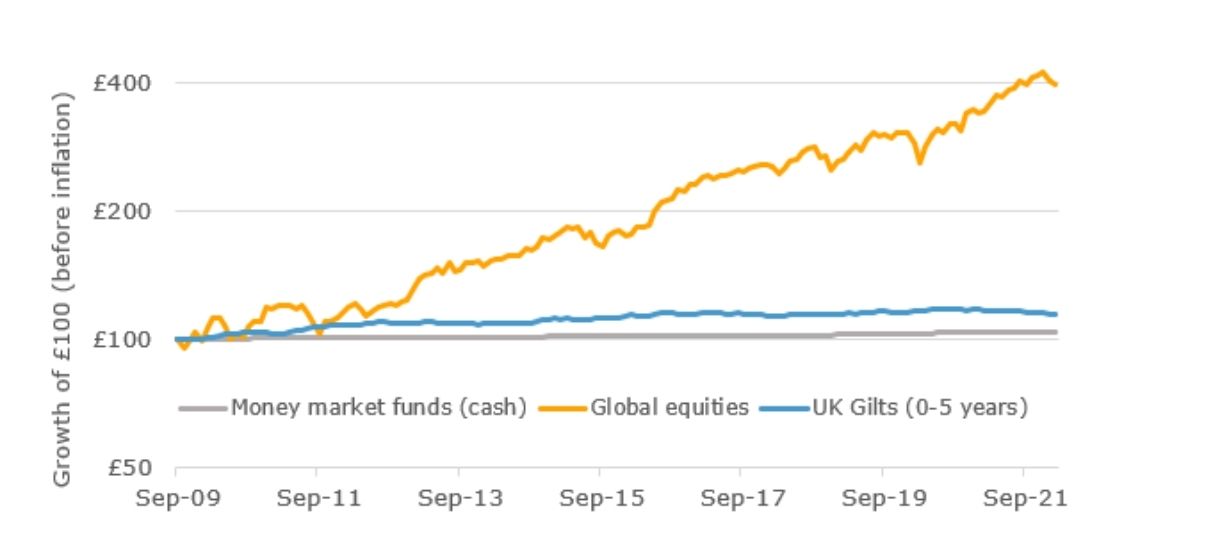

Figure 1: Compared to equities, high quality short-dated bonds and cash are quite similar

Data source: IA Standard Money Market sector average – IA, iShares Core MSCI World UCITS ETF Acc. GBP in GB, iShares UK Gilts 0-5yr UCITS ETF 0 5 GBP TR in GB – iShares.

It is never comfortable confronting a tough reality but understanding that reality and recognising that the alternatives are limited, can help you to deal with it in a rational way.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.