Changes to the iShares Global Property Fund

As part of our ongoing service and due diligence, we like to keep a close eye on anything that changes, not only with your circumstances, but where you’re invested. When something changes with your investment, we like to keep you informed. Last year, BlackRock (who manage the fund) held an Extraordinary General Meeting to discuss one of their funds, the iShares Global Property Securities Equity Index Fund.

The discussions centred around:

- Changing the index which the fund tracks to a similar index, but with a focus on reducing carbon emissions.

- Changing the name from the iShares Global Property Securities Equity Index Fund to the iShares Environment & Low Carbon Tilt Real Estate Index Fund to reflect the proposed change to the funds benchmark index.

These changes were approved by the board at the end of last year and will now come into effect.

About the iShares Environment & Low Carbon Tilt Real Estate Index Fund

- It is an index tracking fund, meaning that it tracks an index of companies. For example, if you were to hold an index fund for the FTSE 100, then this fund would buy and sell companies in accordance with the constituents of that index (the FTSE 100).

- The fund previously tracked an index called the FTSE EPRA NAREIT Developed Index which is designed to represent real estate worldwide by investing in companies that invest in real estate, rather than investing in property directly.

- The fund is used as part of our portfolio as a low-cost way of investing in property, whilst not being fully exposed to the liquidity and diversification risks that can come with holding property directly.

What the new benchmark index means

- There is a growing emphasis on Environmental, Social and Governance (ESG) factors in the world as more people are becoming more conscious of their spending and investing decisions.

- As the fund is an index tracking fund, and the benchmark index will be changing, this will make a slight change to how your money is invested.

- The reason the benchmark is changing is to have an exposure to property with ESG factors in mind.

- The new index aims to screen out companies which have a negative effect on carbon emissions and the following are used as metrics to measure this:

- Allocation of green certificates

- Carbon intensity

- Energy usage

- Due to the nature of the fund, property, the negative screening will exclude only a small number of companies.

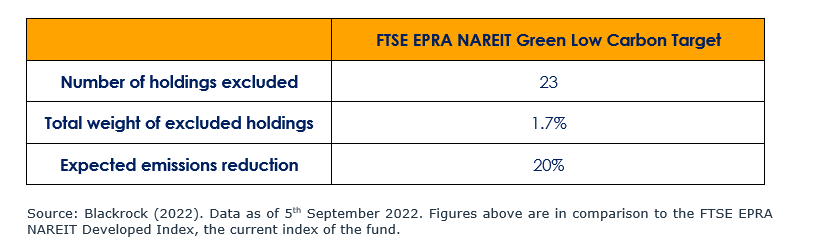

The table below demonstrates the key differences between the previous and current index:

Source: Blackrock (2022). Data as of 5th September 2022. Figures above are in comparison to the FTSE EPRA NAREIT Developed Index, the current index of the fund.

What it means for you

- As mentioned before, we all are becoming more conscious of our spending decisions, carbon footprint, and impact on society. The theory behind investing into companies who score well against ESG metrics, is that those companies may perform better in the future compared to those companies that don’t. This can be down to:

- Increasing fines and legislation increasing costs and reducing profits of those companies which have a negative environmental impact.

- Increased value placed on those companies which have a positive impact, and therefore their share prices.

- Subsidies for those companies who have a positive impact helps with their cashflow and investment.

- There is little change in terms of diversification, with the number of holdings expected to reduce by less than 2%.

- Blackrock will not charge a premium for management of the fund or for making these changes.

- We expected the fund will pay an additional 0.005% due to additional index licence fees

Since the changes will be small, we do not expect any significant changes in either performance or volatility of the fund.

Do you need to do anything?

- In short, no. The name change has happened automatically, as has the change of the index.

- As with all the funds we recommend, we will keep this fund under close review as part of our quarterly investment committee meetings. If we believe a better solution is available, we will keep you informed and recommend a change if necessary.

- In principle, any changes with aim of reducing carbon emissions are welcomed providing it does not bring any detrimental effects, such as significant reduction in performance, diversification, or increased costs. We are therefore happy with the changes expected by the changes to the fund.

As ever should you have any questions about these changes, or indeed anything else, please do not hesitate to contact us.