The big bond bounce-back (for some)

The poor performance of both bonds and equities in 2022 and early 2023 is something that most investors would probably like to forget! It was, for many investors, their first experience of bonds falling in value, particularly at the same time as equities. Depending on the type of bonds held, different investors would have experienced different outcomes. Let’s revisit what has happened in the market since then and evaluate the recovery of different types of bonds.

Key characteristics of bonds

Let’s first take a look at the characteristics that apply to bonds…

- Bond prices move in the opposite direction to bond yields i.e. when bond yields rise, bond prices fall.

- The prices of bonds with maturities further into the future are more sensitive to changes in yields than shorter-maturity bonds, making their prices more volatile.

- The lower the quality of the borrower issuing the bonds, the more like equities they behave.

- Bond markets do not like inflation, generally driving up yields in the face of rising inflation.

What happened to bonds in 2022?

The instability of the UK Conservative government under Liz Truss with unfunded tax promises, along with the growing threat of high inflation following Russia’s invasion of Ukraine, saw bond yields rise dramatically and substantially.

Those owning longer-dated bonds suffered material and painful falls in value as the bond see-saw moved violently, whilst those with shorter-dated bonds fared better but still saw falls in value. Yet, bond owners from that point on began to benefit from the higher yields that their bonds now delivered, recouping some of those falls in value.

The recovery of shorter-dated bonds

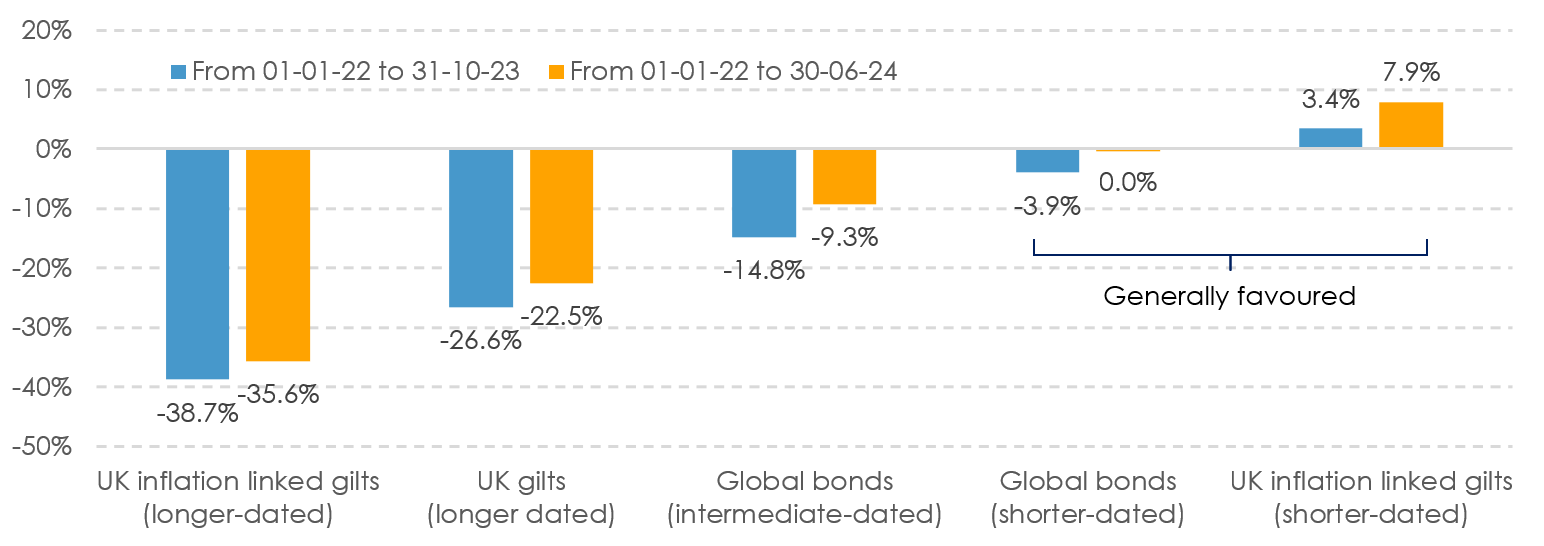

The chart below shows how far bonds fell for different maturities and what the return has been in cumulative terms since the start of the fall. It’s clear to see a big bond bounce-back for shorter-dated bonds has occurred, with them recovering back to where they started, while longer-dated bonds still sit deeply underwater.

Figure 1: Bond falls and recoveries vary depending on what you own

Source: Morningstar Direct © All rights reserved – see endnote for details.

It is evident that shorter-dated bonds have recovered far more quickly than longer-dated bonds as the prices fell less far. The consequent higher yields have helped to recoup these falls, at least in nominal, pre-inflation terms. At their worst, shorter-dated global bonds were down around -7% in 2022. However, they delivered just over +5% in 2023, and around +1% to the end of June this year following small yield rises across major markets.

We have always tended to favour shorter-dated bonds for this reason believing that the small premium available in lending for longer is outweighed by the downside protection that comes from owning shorter-dated bonds alongside their bounce-back-ability!

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Use of Morningstar Direct© data

© Morningstar 2024. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

Data series used:

| Instrument | Asset class proxy |

| L&G All Stocks Index Linked Gilt Idx Tr, GB00B84QXT94 | UK inflation linked gilts (longer-dated) |

| L&G All Stocks Gilt Index Trust, GB00B8344798 | UK gilts (longer dated) |

| Vanguard Global Bd Idx, IE00B50W2R13 | Global bonds (intermediate-dated) |

| Vanguard Global S/T Bd Idx, IE00BH65QG55 | Global bonds (shorter-dated) |

| Albion Constant Maturity Bond Index (3Y, real) | UK inflation linked gilts (shorter-dated) |